I purchased PiggybankPro.com as part of the DNAcademy Investor Challenge for $42.22 total ($30 GoDaddy Auctions closeout + renewal + tax).

Pricing: I’ve listed it for sale at $12,888 with lease-to-own and offer options, and I’m happy to keep as a “forever name” in my personal portfolio because I like it so much.

Market Context: HugeDomains owns 26 “piggybank” domains ‒ CryptoPiggybank.com leads at $12,995, GetPiggybank.com at $11,995 (view all).

In my opinion, the alliteration and memorability of PiggybankPro.com justifies the premium pricing.

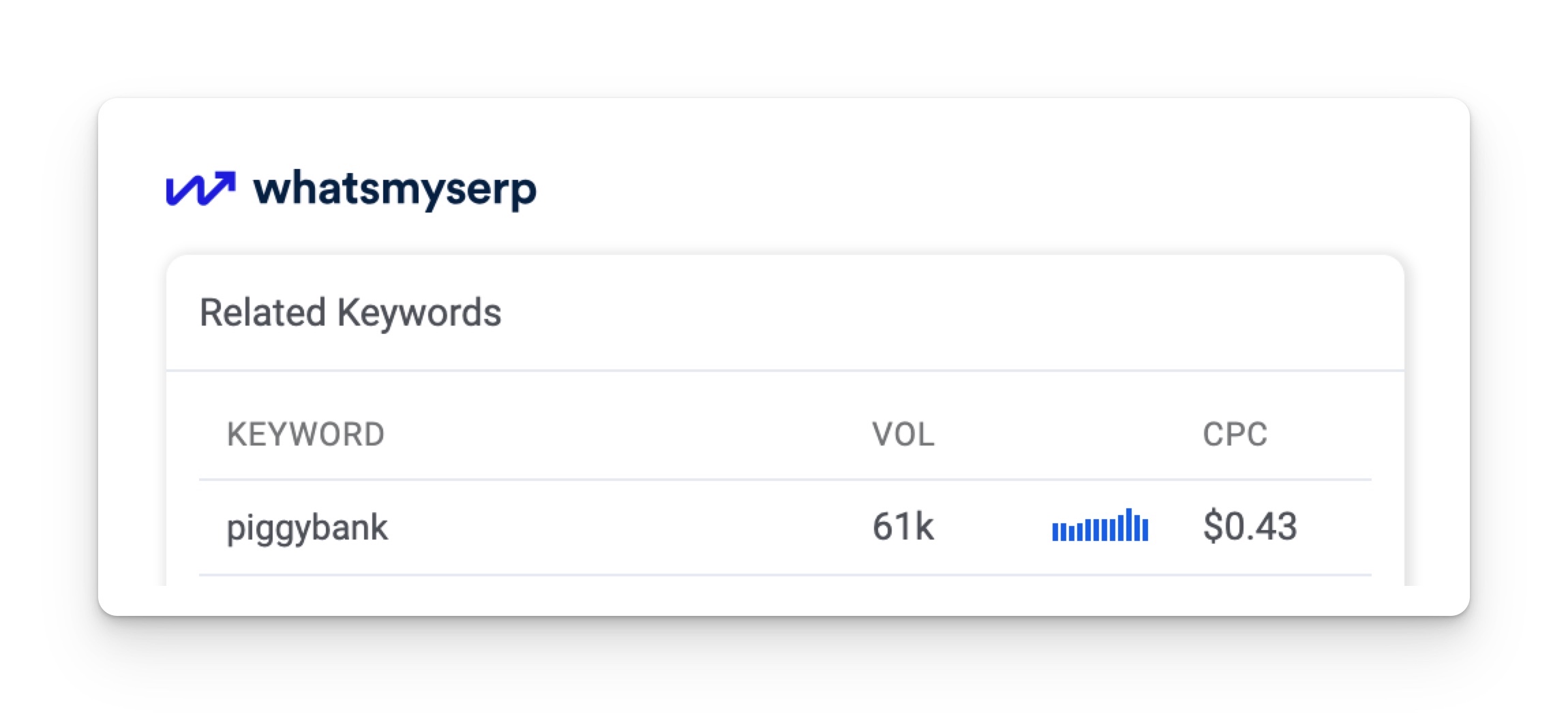

But if you look at the search volume per month, you can see that it’s use in culture is indisputable:

Challenge Wholesale: PiggybankPro.com is available for a wholesale purchase price of $299 to another investor until April 1, 2026, providing them 20x-50x ROI potential — a $5,980 to $14,950 flip value. First come, first served. (I really hope an end user doesn’t see this post.)

Why I Love It: The name is incredibly versatile and memorable with strong alliteration. It screams “financial management” and “professional money tools” while working for everything from personal finance apps to business banking to investment platforms. The “Pro” suffix provides instant credibility as the premium solution with upsell subscription potential.

Here is my forced rank listing of business models for a PiggybankPro.com app.

1. Debt Management and Payoff App

Overview: Comprehensive tool for managing and paying off various types of debt.

Target User: Anyone drowning in student loans and credit card debt looking for a clear payoff strategy.

Target Market: Individuals with consumer debt, student loans, or credit card balances.

Market Size: ~45 million Americans with student debt, plus millions more with credit card and other consumer debt (TAM [total addressable market size]: ~80M people).

Value Proposition: Personalized payoff strategies with interest savings calculations.

Revenue Model: Freemium with debt consolidation referral commissions.

Key Features: Debt snowball/avalanche calculators, creditor communication templates, progress tracking.

Ease of Building: Simple – Basic calculators and progress tracking, straightforward CRUD operations.

Usefulness Rating: High – Massive student debt problem, people actively seek debt relief solutions and recommend helpful tools.

Overall Ranking: #1 – Best opportunity – Straightforward to build, massive market (student debt crisis), people actively seek debt solutions and recommend helpful tools. High viral potential among recent graduates. 8 Best Debt Settlement Affiliate Programs of 2025.

2. Budgeting for College Students

Overview: Financial management app specifically designed for college life.

Target User: College sophomore learning to manage part-time job income, scholarships, and textbook expenses.

Target Market: College students aged 18-24 living on limited budgets.

Market Size: ~20 million college students in the US, many living on tight budgets (TAM: ~25M including recent graduates).

Value Proposition: Student-specific budgeting templates with textbook/school expense tracking.

Revenue Model: Free basic version with premium features at $2.99/month.

Key Features: Part-time job income tracking, scholarship management, meal plan optimization.

Ease of Building: Simple – Basic budget templates and expense tracking, straightforward CRUD operations.

Usefulness Rating: High – College students need budget help, high viral potential through campus sharing and social media.

Overall Ranking: #2 – Second best – Simple to build, huge college student market, immediate need, high viral potential through campus sharing. Students actively seek budget help and recommend useful apps.

3. Personal Finance Management App

Overview: Comprehensive mobile app for tracking income, expenses, and financial goals.

Target User: Busy young professional juggling multiple income streams and expenses who wants automated insights without manual data entry.

Target Market: Young professionals aged 25-40 earning $50K-$150K annually.

Market Size: ~100 million working adults in the US who manage personal finances (TAM: ~150M people aged 25-65).

Value Proposition: AI-powered insights with automated categorization and spending alerts.

Revenue Model: Freemium with premium features at $4.99/month.

Key Features: Budget creation, bill reminders, investment tracking, credit score monitoring.

Ease of Building: Medium – Requires complex categorization algorithms and AI integration, multiple data sources to sync.

Usefulness Rating: High – Universal need for financial tracking, people actively seek budgeting solutions and recommend helpful finance apps.

Overall Ranking: #3 – Strong contender – Medium complexity but universal need, people actively seek budgeting solutions. Large market of young professionals who would recommend good finance apps.

4. Small Business Expense Tracker

Overview: Simplified accounting tool for freelancers and small business owners.

Target User: Freelancer or consultant who hates doing taxes and tracking receipts manually every quarter.

Target Market: Freelancers, consultants, and businesses with under $500K annual revenue.

Market Size: ~15 million freelancers and ~6 million small businesses in the US (TAM: ~25M business entities and individuals).

Value Proposition: One-click expense categorization with tax preparation assistance.

Revenue Model: Tiered subscription: $9.99/month (basic), $24.99/month (pro).

Key Features: Receipt scanning, mileage tracking, quarterly tax estimates, invoice generation.

Ease of Building: Medium – Requires OCR for receipt scanning and tax calculation logic.

Usefulness Rating: High – Solves real pain point for business owners, high likelihood of recommendations during tax season.

Overall Ranking: #4 – Good opportunity – Medium build complexity but solves real pain point (tax season), freelancers actively recommend helpful business tools. Clear value proposition for target users.

5. Investment Education Platform

Overview: App combining micro-investing with educational content for beginners.

Target User: Recent college grad interested in investing but intimidated by stock market complexity.

Target Market: First-time investors aged 18-30 with limited financial knowledge.

Market Size: ~50 million Americans interested in investing but lacking knowledge (TAM: ~80M people aged 18-40 with disposable income).

Value Proposition: Risk-free virtual trading alongside real micro-investments.

Revenue Model: $2.99/month subscription plus affiliate fees from brokerage partners.

Key Features: Bite-sized financial lessons, virtual portfolio simulation, real-money micro-investing.

Ease of Building: Medium – Virtual trading simulation engine and educational content management.

Usefulness Rating: High – Growing interest in investing, education gap exists, high viral potential among young adults.

Overall Ranking: #5 – Solid potential – Medium build, growing interest in investing, education gap exists. High viral potential among young adults interested in building wealth.

6. Automated Savings Platform

Overview: App that automatically rounds up purchases and invests spare change.

Target User: Young adult with inconsistent cash flow who struggles with manual savings and wants to build wealth effortlessly.

Target Market: Millennials and Gen Z with irregular income patterns.

Market Size: ~80 million millennials and Gen Z adults in the US who could benefit from automated saving (TAM: ~100M people aged 18-40).

Value Proposition: Set-and-forget savings with gamification and social sharing.

Revenue Model: 0.25% annual management fee on saved/invested funds.

Key Features: Real-time purchase rounding, multiple savings goals, partner rewards program.

Ease of Building: Medium – Needs bank integration APIs (like Plaid) and investment account connections.

Usefulness Rating: Medium – Good for millennials/Gen Z but requires bank linking commitment that many avoid.

Overall Ranking: #6 – Moderate opportunity – Medium build, appeals to millennials but bank linking creates adoption barrier. Good for passive savers but not essential enough for widespread recommendation.

7. Family Financial Planning Tool

Overview: Collaborative platform for families to manage shared finances and goals.

Target User: Married couple with kids trying to coordinate household budget and teach children about money.

Target Market: Families with children, particularly those planning for college or retirement.

Market Size: ~30 million US families with children under 18, plus millions planning for college/retirement (TAM: ~40M households).

Value Proposition: Joint budget tracking with educational content for financial literacy.

Revenue Model: Family subscription at $14.99/month with up to 5 users.

Key Features: Shared accounts, allowance tracking for kids, family financial education modules.

Ease of Building: Medium – Multi-user account management and shared data synchronization required.

Usefulness Rating: Medium – Useful for families but many manage finances manually or use separate tools.

Overall Ranking: #7 – Limited potential – Medium build, useful but many families manage finances manually. Not enough pain point to drive widespread adoption and recommendations.

8. Cryptocurrency Portfolio Tracker

Overview: Professional-grade crypto portfolio management and analytics.

Target User: Active crypto trader managing multiple exchange accounts who needs consolidated tracking.

Target Market: Active cryptocurrency traders and long-term holders.

Market Size: ~10 million active cryptocurrency users in the US, with growing mainstream adoption (TAM: ~20M crypto-interested adults).

Value Proposition: Real-time tracking across 100+ exchanges with tax reporting.

Revenue Model: Tiered subscriptions from $12.99-$49.99/month.

Key Features: DeFi yield tracking, tax-loss harvesting, performance analytics, price alerts.

Ease of Building: Complex – Requires integration with 100+ exchange APIs and real-time data processing.

Usefulness Rating: Medium – Niche market with many existing solutions, crypto users are tech-savvy and willing to recommend good tools.

Overall Ranking: #8 – Niche opportunity – Complex build, niche market with existing solutions. Crypto users recommend good tools but market saturation and technical complexity hurt opportunity.

9. Retirement Planning Calculator

Overview: Advanced retirement planning tool with Monte Carlo simulations.

Target User: Mid-career professional worried about retirement savings who wants detailed projections.

Target Market: Professionals aged 35-55 concerned about retirement readiness.

Market Size: ~60 million Americans aged 35-65 who should be planning for retirement (TAM: ~80M people in prime earning years).

Value Proposition: Hyper-accurate projections with scenario planning capabilities.

Revenue Model: One-time $49.99 purchase with optional $9.99/month updates.

Key Features: Social Security optimization, tax strategy integration, healthcare cost modeling.

Ease of Building: Complex – Monte Carlo simulations require advanced financial modeling and statistical calculations.

Usefulness Rating: Medium – Important topic but most people procrastinate on retirement planning despite needing it.

Overall Ranking: #9 – Challenging opportunity – Complex build, important topic but people procrastinate on retirement planning. Despite need, adoption would be low due to complexity.

10. Real Estate Investment Planner

Overview: Tool for analyzing and tracking real estate investment opportunities.

Target User: Aspiring real estate investor analyzing rental property opportunities before making purchase decisions.

Target Market: Aspiring real estate investors and current property owners.

Market Size: ~5 million aspiring real estate investors and active property owners in the US (TAM: ~10M people interested in real estate investment).

Value Proposition: ROI calculations with market analysis and property management features.

Revenue Model: Commission on property referrals plus $19.99/month premium features.

Key Features: Rental property calculators, mortgage optimization, property comparison tools.

Ease of Building: Complex – Requires market data integration, complex ROI calculations, and real estate APIs.

Usefulness Rating: Medium – Niche market with high barrier to entry, useful for serious investors who would recommend to peers.

Overall Ranking: #10 – Least opportunity – Complex build, niche market with high barrier to entry. Smaller user base, existing tools available, technical complexity makes this least attractive.