Though I have been skeptical of Web3 hype, the model presented below demonstrates a practical way Web3 can unlock new financing structures in premium domain investing.

This article examines a promising Web3-based structure for high-value domain investing by clearly distinguishing between two essential parties:

- The Domain Investor: The individual or entity responsible for acquiring, marketing, negotiating, and ultimately selling the premium domain name asset.

- The Fractional Investors: Individuals who contribute capital to the opportunity through a Web3-enabled, smart contract–secured arrangement, in exchange for a proportional share of the potential profits and a non-guaranteed return that is higher than traditional investments.

Both roles are distinct and foundational to structuring the opportunity, risk, and potential upside inherent in this approach.

A New Model for Unlocking Domain Value

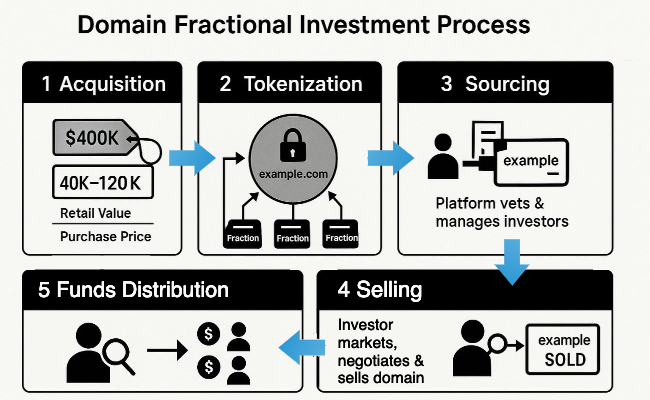

1. Sourcing and Acquiring Well Below Retail Value

Experienced Domain Investors can sometimes acquire desirable one-word .com or .ai domains for just 10% to 30% of their retail value.

For example, a domain name appraised at a fair-market retail valuation of $400,000 can sometimes be opportunistically acquired for $40,000 to $120,000 using industry savvy and negotiation.

2. Using Web3 for Fractional Investment and Domain Management

Domain finance (“domainfi”) platforms propose tokenizing domain names to sell shares to Fractional Investors while letting the Domain Investor retain control.

The domain is locked by a smart contract, ensuring no single party can move or transfer the asset alone.

The platform can also reserve funds to cover annual domain renewal fees for a number of years, preventing missed renewals and accidental expiration of the asset during the tokenization period.

Sequencing: Acquisition Before Fractionalization

In practice, the Domain Investor should acquire the domain outright (or via a Special Purpose Vehicle [SPV] they control) before any fractional investment is offered. This ensures the asset exists, can be placed under contractual/technical lock, and is not a hypothetical raise.

- Domain Investor acquires the domain and moves it to a registrar account with transfer locks and optional registry lock.

- The platform records the domain into a smart contract (and/or custodian workflow) that disables unilateral transfer.

- The fractional offering launches; proceeds reimburse the Domain Investor per terms and fund the investor payout waterfall and renewals reserve.

Alternatives like “soft commits” can be used, but the offering should not close unless the domain is in the investor’s control and locked per the platform’s rules.

3. Sourcing Fractional Investors

Much of the obligation to find Fractional Investors falls to the domainfi platform, although the Domain Investor can help.

The platform handles sourcing, vetting, and onboarding investors seeking high returns, while managing contracts in exchange for compensation.

For this service, the platform takes a commission or fee.

4. Selling the Domain and the Domain Investor’s Role

After funding, the entire responsibility for marketing and selling the domain falls on the Domain Investor.

The Domain Investor must find a retail buyer or otherwise generate liquidity, which is what ultimately allows Fractional Investors to get their return.

5. Closing the Sale and Distributing Proceeds

After the Domain Investor sells the domain, the platform’s smart contract collects the proceeds and automatically pays Fractional Investors their original capital plus agreed returns first.

Then it pays any fees and distributes the remaining funds to the Domain Investor.

This ensures a secure, transparent, and orderly payout process.

Structuring Ownership, Returns, and Exit Scenarios

Suppose the Domain Investor sells 49% ownership to Fractional Investors, raising $108,000.

And also suppose Fractional Investors require a 30% annualized return over 5 years.

Target Sale Price and Payout Priority

- The expected retail sale price is roughly $400,000.

- Upon sale, proceeds pay Fractional Investors first: they receive their principal plus the contracted 30% annualized return (about $401,004 after 5 years).

- Any proceeds beyond this threshold go to the Domain Investor.

- If the sale is around $400,000, virtually all proceeds pay Fractional Investors; for higher sales, the Domain Investor keeps all upside above the investor payout.

This means Fractional Investors get a robust, protected fixed return, while the Domain Investor “buys the domain for free” up front and is incentivized to sell for more than $400,000 to realize further profit. It’s a win-win scenario.

Sample Scenario Table

| $40,000 Acquisition | $120,000 Acquisition | Each Fractional Investor (10 investors) | |

|---|---|---|---|

| Capital Outlay (Domain Investor) | $40,000 | $120,000 | $10,800 |

| Capital Raised from Fractional Investors | $108,000 | $108,000 | N/A |

| Retained Ownership (Domain Investor) | 51% (worth $0 at $400k sale*) | 51% (worth $0 at $400k sale*) | 4.9% per investor |

| Payout when Fully Funded (Domain Investor) | $108,000 – $40,000 = $68,000 | $108,000 – $120,000 = -$12,000 | N/A |

| Fractional Investor Return | N/A | N/A | $39,960 each 3.7× invested capital (30% annualized ROI) |

| Upside on Sale Above $400k | 100% to Domain Investor | 100% to Domain Investor | N/A |

* If sale is $400,000, all proceeds go to Fractional Investors until they reach their $401,004 payout (payout slightly capped by total available). Domain Investor receives only what was raised initially ($108,000), not a percent of the sale.

What If the Domain Appreciates Above $400,000?

- If the Domain Investor sells for $500,000:

- Fractional Investors get their full $401,004.

- Domain Investor receives the $98,996 difference ($500,000 – $401,004).

- If the Domain Investor sells for $650,000:

- After $401,004 is paid to Fractional Investors, the Domain Investor receives $248,996.

This structure means the incentive for the Domain Investor is to work for the best possible sale, maximizing upside returned solely to them once Fractional Investors are made whole.

Both scenarios don’t account for renewal fees that are reserved, or platform commissions which are unknown.

Protections for Fractional Investors

To protect Fractional Investors and align incentives, the smart contract could enforce:

- Priority Payback: Fractional Investors are compensated their original investment plus agreed-upon return before the Domain Investor sees any proceeds beyond the initial raise.

- Automatic Renewal Maintenance: Part of the investment is set aside to cover annual renewals, protecting Fractional Investors from asset expiry risk.

- Domain Investor Receives Surplus Only: Only after Fractional Investors’ full payout does any subsequent sales money go to the Domain Investor.

- Secondary Market Liquidity: Fractional Investors can potentially sell their shares to others on a Web3-powered secondary market before the asset sells, offering liquidity even if the exit is delayed.

- Clear Succession Planning: If the Domain Investor passes away or disappears, the smart contract could require a trustee or automated failover to a professional domain escrow service acting for the investors. This ensures the asset remains secured and investors maintain recourse to realize value.

- UDRP Defense Hold-Back: To protect the investment against spurious UDRP (Uniform Domain-Name Dispute-Resolution Policy) claims, a portion of the initial funds raised from Fractional Investors can be set aside as a hold-back. This reserve would cover the estimated cost to defend a UDRP, including the fee for a 3-person panel (typically around $2,000) plus an additional $5,000 for attorney expenses. If no UDRP claim is filed prior to the sale of the domain, these hold-back funds are released and disbursed to the Domain Investor at closing. This approach ensures all parties are protected from legal surprises without penalizing the Domain Investor if no dispute arises.

Governance for Downside and Misaligned Incentives

In adverse markets, Fractional Investors may prefer a lower immediate sale (e.g., $200,000) while the Domain Investor may prefer to wait for a higher but uncertain price.

To reduce this conflict, the deal should encode clear downside governance:

- Time-Based Sale Triggers: After a set period (e.g., 36 months), a bona fide offer above a threshold (e.g., capital plus a minimum APR) can be approved by a supermajority of tokens (e.g., 66%) to force a sale.

- Reserve and Auction: Permit investors to call an auction with a formula-defined reserve (e.g., independent appraisal median × a discount factor) once the trigger window opens.

- Waterfall Carve-Out at Sub-Threshold Sales: To avoid holdout, allocate a small percentage (e.g., 5–10% of gross proceeds) to the Domain Investor even when the total is below the full investor payout. The remainder follows the investor-first waterfall.

- Return Step-Down: After a certain number of years, investor APR may step down annually to reduce wedge risk while still prioritizing investors.

- Buy/Sell Options: Give either side options at a formula price (e.g., Domain Investor call option to buy out tokens; investor put option to sell to the manager/SPV) to resolve stalemates.

These mechanics preserve investor protection while giving the Domain Investor a rational incentive to transact even when the sale is below the original target.

Risks, Due Diligence, and Realistic Timeframes

Assuming a five-year exit is an estimate; actual sales may occur much sooner, much later, or potentially never. This matters for true returns.

For example, if the domain takes 10 years to sell, the effective annualized return on the same fixed payout ($401,004 on a $108,000 investment) drops to about 17.4%, calculated as:

If it takes 20 years, the return drops to about 9.4%, calculated as:

Fractional Investors must conduct due diligence. Reviewing the Domain Investor’s background, reputation, success and reputation is paramount. Also, obtaining multiple independent valuations, and understanding the legal terms in case of long sale times or no sale are essential.

There is market opportunity for platforms that provide these services, offer transparent prospectuses, and facilitate secondary trading.

Why Web3 Makes Sense for This Use Case

- Trustless Security: Fractional Investors are protected because the domain is held in a smart contract, preventing anyone from misappropriating the asset (no “rug pulls”).

- Automated Governance and Payouts: Investor and Domain Investor payments are automated, transparent, and accrue in priority via programmable contracts, possibly linked with established escrow services.

- Broader Access to Capital: A 30% annual ROI is attractive and can draw new categories of investors to the asset class, with fractional and secondary market options, benefiting both Domain and Fractional Investors.

ICANN Registrant of Record with Fractional Investors

ICANN and registrars require a single legal Registrant of record. In a fractional model, the Registrant should be the Domain Investor or a SPV they control. The fractional ownership and payout rights live in the on-chain contract and associated legal agreements.

- WHOIS/Registrant: Shows the Domain Investor or SPV. This party is contractually bound by the smart contract and legal docs to act for Fractional Investors.

- Enforcement: Registrar transfer locks, optional registry lock, and a platform-controlled multi-party transfer approval process prevent unilateral moves.

- On Sale: The Registrant executes the transfer only after the smart contract escrows proceeds and triggers the waterfall distribution.

Securities and Regulatory Considerations

Fractional interests coupled with a manager’s efforts will often meet the Howey test and be treated as securities. Practical implications include:

- Offering Exemptions: In the U.S., consider Reg D (506(b) or 506(c)) for accredited investors, or regulated pathways like Reg CF or Reg A+.

- KYC/AML and Transfer Restrictions: Investor onboarding and secondary transfers must follow compliance rules; secondary trading may require an ATS or broker-dealer participation.

- Blue Sky/Form D: File and notice as required; adhere to marketing rules for the chosen exemption.

- Custody and Escrow: Use qualified custodians/escrow arrangements for fiat and on-chain assets as needed.

This is not legal advice. Platforms and Domain Investors should consult counsel before offering fractional interests.

Final Thoughts

Despite my continued skepticism toward Web3, this model demonstrates that with the right structure and incentives, Web3 technology can enable Domain Investors to acquire and profit from premium domains without risking their own capital up front while offering Fractional Investors strong, contractually protected returns on their investment.

In the scenario presented above, incentives can be aligned when the contract encodes downside governance, investor priority, and sale triggers. With those in place, transparency is embedded and risks are managed openly, and Web3 can add real value for domain investment.

Acknowledgments and Feedback

Special thanks to Bob Hawkes for his thoughtful peer review and suggestions that improved clarity and balance.